Category: Personal Tax

Spring Budget 2024 – The leaked and leaky Budget

Spring Budget 2024

The Chancellor managed to find some optimism in the deteriorating economic forecasts, as most Chancellors, of whatever political hue, seem to do before an election. Mr Hunt announced a further 2% cut to national insurance, although it appears that the current budget deficit and the anticipated fall in inflation to 2% did not arrive in time to arm the Chancellor with the fireworks needed to queue an election. With this in mind, the Autumn Statement 2024 is now likely to be the “main event”, if we may, for the Conservatives to bring in a final raft of measures, including perhaps Mr Sunak’s long-forgotten “promise” to slash the basic rate of income tax from 20p to 19p by 2024.

Indeed the speech from Mr Hunt did not feel like a genuine election push; he rather serenaded the opposition and there was an absence of an impassioned pre-election tone. The Conservatives have accepted this election will go very late, or perhaps they have accepted that they will go down with dignity (and cheques that will bounce back).

Whereas in years gone by ministers responsible for leaks to the press resigned on the spot, party politicians have warmly embraced the new age of “populism” and the Budget was leaked, in drips and drabs over the course of the past few days, to various news organisations.

Headlines and commentary as follows…

Spring Budget 2024

Personal taxes

- Tax Rules for non-UK domiciled individuals – from 6 April 2025, the current remittance basis of taxation will be abolished for UK resident non-domiciled individuals. This will be replaced from 6 April 2025 with an elective 4-year foreign income and gains (FIG) regime for individuals who become a UK tax resident after a period of 10 years of non-UK tax residence. There will also be transitional provisions for non-doms currently paying tax on the remittance basis, including a 12% tax rate on foreign income arising before April 2025 but brought into the UK in the tax years 2025/26 or 2026/27. Do the Conservatives now feel that the abolition of these breaks will not result in a mass exodus? In practice, looking at the polls and the fairly imminent election, this particular measure won’t be in place before there is a change in government and any actual amendments to the regime are likely to be quite different.

- High Income Child Benefit Charge (HICBC) – the HICBC income threshold will be raised from £50,000 to £60,000 from 6 April 2024, and the taper will be extended up to £80,000. A migration to a system based on household rather than individual income is planned by April 2026.

- ISAs – introduction of a UK ISA with a new £5,000 allowance, in addition to the existing ISA allowance.

National Insurance contributions – whilst any “tax” cut is welcome, one must recall that the same percentage increase was levied by the same party in order to fund “social care”. Have then, the problems of social care been solved? Or do they no longer matter? The state of our public services will quite possibly be the biggest challenge of the next elected party.

- Class 1 – a cut to the main rate of Class 1 employee NICs from 10% to 8% from 6 April 2024.

- Class 2 & 4 NICs – a further cut of 2 pence to the main rate of Class 4 self-employed NICs from 6 April 2024, taking this to 6% of profits. The consultation to abolish Class 2 NICs to continue.

Property

- Capital Gains Tax (CGT) – a reduction to the higher CGT rate for residential property disposals from 28% to 24%. The change will take effect for disposals that take place on or after 6 April 2024. The lower rate of 18% will remain unchanged. For those with second homes, perhaps a “softener” to finance the VAT to be paid on school fees after the election?

- Furnished Holiday Lettings (FHL) – Were the tax breaks really responsible for exacerbating housing pressures of tourist areas to the detriment of local residents (many of whom also happen to be voters in marginal seats)? Draft legislation to be published in due course, but from April 2025, the generous tax advantages afforded to FHLs operating as either individuals or corporates will be abolished.

Excise and Duties

- VAT

- The VAT threshold will increase to £90,000 from 1 April 2024, and the level at which a business can apply for de-registration will increase from £83,000 up to £88,000. It is good to see the VAT threshold increasing, but we can’t help but ask Mr Hunt: why not go big and move the threshold to say £100,000? We feel that this would move the stifling cliff edge quite some distance for smaller traders; plus, a higher threshold could have taken out a large swath of businesses and reduced demand on HMRC, who are clearly struggling to perform.

- Also, the VAT implications for the private hire vehicle sector will be examined in April 2024, with potentially full expensing to give 100% corporation deductions for qualifying capital expenditure.

- Stamp Duty Land Tax (SDLT)

- First Time Buyers’ Relief will be extended to individuals who use nominee and bare trust arrangements when buying a new lease over a dwelling that they intend to use as their main or only residence.

- Abolition of Multiple Dwellings Relief, a bulk purchase relief within the SDLT rules available on the purchase of two or more dwellings.

- Vaping Duty – a new duty on vaping products will be introduced in October 2026, details on the design and implementation to be announced.

Business taxes

- Energy Profits Levy – the “temporary” tax on oil & gas profits introduced in 2022 has been extended to 1 March 2029. However, alongside this extension is a separate measure which will switch off this tax automatically if the average price for both oil & gas drops below certain thresholds.

- Creative Industries – New permanent rates of relief (40% and 45%) for theatre, orchestra and museums and galleries exhibition tax, and additional support for independent film through a new UK Independent Film Tax Credit at a rate of 53% for films with budgets under £15 million that meet the conditions of a new British Film Institute test. Plus, a 5% increase in tax relief for UK visual effects costs in film and high-end TV, under the Audio-Visual Expenditure Credit (AVEC).

- R&D – an expert advisory panel to support the administration of research and development (R&D) tax reliefs.

Tax administration

- Cryptoasset Reporting Framework (CARF) – the government has launched a consultation to seek views on how best to implement the Cryptoasset Reporting Framework and Amendments to the Common Reporting Standard.

Visit our Budget Highlights and tax data for a summary of the Spring Statement 2024.

Contact Mouktaris & Co Chartered Accountants for expert advice or click here to subscribe to our Newsletter.

Payrolling Benefits

What is a Benefit in Kind?

Benefits in kind (BIKs) are benefits that employees or directors receive from their employer which aren’t included in their salary or wages. BIKs are popular elements of many people’s salary packages and can be used by an employer to structure an effective and tax-efficient salary package.

Some BIKs aren’t taxed, but most are. As well as the impact on an employee’s personal tax, national insurance contributions are payable by companies, such that the tax treatment is broadly similar to that when paying a salary (although employer pension contributions are not due on BIKs).

What is Payrolling Benefits?

We are encouraging employers to take advantage of using payroll facilities for the purpose of reporting expenses and benefits. Rather than filing an annual P11D, an employer can report and deduct tax on the value of benefits provided to an employee each pay period though PAYE. This means doing away with the end of year P11D process, as taxes are submitted in real time.

HMRC will issue an employee with a new tax code to automatically account for the benefit provided and charge the correct amount of tax, in real time.

An employer will still need to complete and submit a P11D(b) form and pay Class 1A National Insurance on the value of the benefit provided to employees.

Employer Duties

Once an employer has registered to payroll benefits, they must give employees written notice explaining which benefits will be payrolled, the cash equivalent of the benefits, and details of benefits that will not be payrolled. Details on communicating with existing and new employees are set out on gov.uk.

Working out the taxable amount of a benefit in kind

The taxable amount of the benefit is the same as its cash value. This is then divided by the number of paydays the employee has in each pay period, so that tax is applied appropriately.

What if the value of the benefit changes?

It’s fairly common for benefits such as gym memberships and car costs to change during the year. If this happens, it’s simple to process the change. You must however ensure to keep us updated with changes when you communicate with us in the normal course of operating payroll. Examples of changes to the value of the benefit provided to the employee include:

- a change in price of the benefit, such as an increase in insurance premium

- a change in the number of days worked by the employee, including if an employee leaves

We recommend you discuss any benefit you plan to offer your company’s directors and employees with one of our expert accountants. As you can see, the rules around benefits in kind are complex and each example needs to be looked at based on its individual circumstances to see if any tax is payable by the employee and/or your company.

Contact Mouktaris & Co Chartered Accountants for expert advice or click here to subscribe to our Newsletter.

ATED Valuation Update for 2023/24 return

ATED Update

Certain companies owning UK residential property need to submit an Annual Tax on Enveloped Dwellings (ATED) return every year. ATED is payable by companies that own properties valued at more than £500,000 if none of the various reliefs apply.

Valuation dates and the 2023-24 ATED return

Valuation dates are relevant for determining a company’s ATED position. It is the value of the property on the most recent of these valuation dates which is relevant for determining the annual chargeable amount due on the property. The previous “valuation date” was 1 April 2017, which applied for the 2018-19 ATED year and all ATED years up to and including this 2022-23 ATED year.

For the forthcoming ATED year 2023-24 and all ATED years up to and including the 2027-28 ATED year, ATED charges will be rebased to 1 April 2022 property values and so a revaluation of properties will be required as at 1 April 2022. ATED Returns are due within 30 days of the start of the relevant chargeable period i.e. by 30 April 2023 for the 2023/24 period.

Property Valuation

If a revaluation has not been carried out on properties, directors should consider doing so as a matter of urgency to ensure that future ATED liabilities are based on the correct valuation. This is especially important if the property is valued close to the ATED bands detailed below. Even if the company’s property is currently relieved from ATED, it would be prudent to have a 1 April 2022 valuation should circumstances change.

Property values were particularly volatile post-Brexit and there were instances where values actually fell when the April 2017 revaluation exercise was undertaken. Given the effects of the coronavirus pandemic on property values, similar considerations may apply when the 2022 valuation exercise is undertaken, although different considerations will apply to different regions and properties.

Directors can ascertain the property value or a professional valuer can be used. Valuations must be on an open-market willing buyer, willing seller basis and be a specific amount.

ATED Annual Chargeable Amounts

Annual chargeable amounts can be found on gov.uk.

Pre-return banding check

If your property falls within 10% of the above value bands and you can’t take advantage of a relief to reduce your ATED charge to nil, we can ask HMRC for a pre-return banding check (PRBC) in advance of submitting your return. If HMRC complete your PRBC after you’ve submitted your return and they don’t agree with your valuation, you’ll need to complete an amended return.

Contact Mouktaris & Co Chartered Accountants for expert advice or click here to subscribe to our Newsletter.

Spring Statement 2023

Back to the Future

Following the “Growth Plan” mini budget delivered by Kwasi Kwarteng on 23 September 2022, Jeremy Hunt took centre stage for the second time on 15 March 2023 to deliver a…”Budget for Growth”.

Fiscal policy can be assessed in three measures: efficiency, effectiveness and equity and whilst the announcements were fairly safe, a handful are poorly timed or likely to be ineffective:

- During an interview with BBC Radio 4 when defending the scrapping of the £1.073m tax-free cap on the lifetime pension allowance, Jeremy Hunt remarked that “we do know that we have a shortage of doctors and we know we have a very big backlog, and that is why we’ve decided this [scrapping of the lifetime pension allowance] is a very important measure to get the NHS working”. Said whilst junior doctors are on prolonged strike over pay and conditions; we suspect that Mr Hunt may have skipped his situational judgement module at Oxford!

- The Spring Budget is designed to “…break down barriers to work, unshackle business investment and tackle labour shortages head on”. Whilst the headline measure of 30 hours of weekly free childcare is a great and targeted initiative, Mr Hunt is making some parents wait up to 2 years and 5 months for the benefit.

As regards equity, the Budget is fairly safe and business-focused, but it does not appeal particularly to small and medium-sized enterprises (SMEs) who now face a rise in corporation tax and who are unlikely to benefit from the full expensing capital allowances policy. In addition the chancellor has failed to take any action to make it easier for small firms to recruit people locked out of the labour market.

In other news regarding:

- Childcare: Extension of 30 hours of weekly free childcare to cover nine-month to two-year-olds for working parents, to be fully phased in by September 2025.

- Taxes: Increase in corporation tax from 19% to 25%.

- Capital allowances: A “full expensing capital allowances policy” under which companies can write off qualifying expenditures against taxable profits.

- Research & Development: From 1 April 2023:

SMEs will received an increased rate of R&D relief from HMRC: £27 for every £100 of R&D investment if they spend 40% or more of their total expenditure on R&D.

the rate of the Research & Development Expenditure Credit (RDEC) is increased from 13% to 20%. - Energy: The government will keep the £2,500 annual cap on household energy bills in place for a further three months until June. Fuel duty has also been frozen for another year.

- Local growth: Tax incentives and other benefits for 12 investment zones across UK cities and towns worth £80m each over five years.

- Pensions:

- The annual tax-free pension allowance will be increased from £40,000 to £60,000.

- The Lifetime Allowance – previously set at £1.07m – will be abolished. The 25 per cent tax-free lump sump will though remain pegged to the current lifetime allowance, rather than 25 per cent of your whole pot.

- The money purchase annual allowance (MPAA) currently capped at £4,000 or £3,600 per tax year, has been increased to £10,000.

- Energy: Investment of £20bn over the next 20 years in carbon capture and storage projects.

- Pubs: A pint will become 11p cheaper but a glass of wine will cost 45p more from August.

Visit our Budget Highlights and tax data for a summary of the Spring Statement 2023.

Contact Mouktaris & Co Chartered Accountants for expert advice or click here to subscribe to our Newsletter.

Autumn Statement 2022

Taxing Times

In the latest decisive swoop of indecisiveness, Jeremy Hunt performed a 180 degree turn from the Mini Budget delivered less than two months ago by his predecessor. If the Mini Budget was dubbed “The Growth Plan”, can the Autumn Budget also be a plan for growth?

It was a step in the right direction: re-implementing fiscal discipline in an effort to re-galvanise trust in HM Treasury. Notwithstanding, it’s disappointing that fairer and more creative means of collecting taxes were not applied, rather than manipulating the tax bands in a move which fiscal-drags one and all. The 40% band no longer applies to the wealthiest. The capital gains tax rates on investment income are still only 50% of those paid on working income.

There were surely opportunities missed to rebalance the tax-system in a much-needed fairer way. Especially now in the face of a looming recession – or potentially depression, when the smallest tweaks in taxes and spending will have knock on effects on the amount of money that is spent on our high streets.

Taxes aside, there is risk of a continued disintegration of public services – this will come home to roost in two years if inflation continues its current trajectory amidst public spending cuts of £28bn.

Visit our Budget Highlights and tax data for a summary of the Autumn Statement 2022.

Contact Mouktaris & Co Chartered Accountants for expert advice or click here to subscribe to our Newsletter.

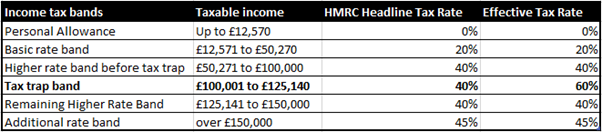

Earning over £100k: how to avoid the 60% Tax Trap

A pay rise or bonus that takes one’s annual income above £100,000 is cause for celebration. Tread though carefully these muddy waters, for additional income earnt up to £125,140 attracts the highest rate of marginal tax across all other taxpayers, including those richer than you. Read on for tax-saving tips on how to navigate the 60% Tax Trap…

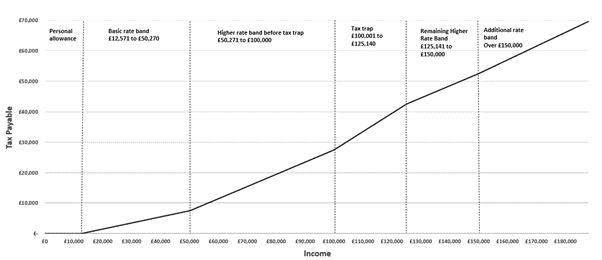

One’s Personal Allowance goes down by £1 for every £2 earnt over £100,000, increasing the amount of income that is taxed at the higher rate of 40%. One loses their Personal Allowance in full when their income reaches £125,140. The graph below illustrates how tax payable accelerates as income increases in the Tax Trap Band. Note the steepest gradient for income earnt in this range.

Avoiding the 60% Tax Trap

The incentive effect, or disincentive effect rather, of working to receive income in the Tax Trap Band, is punitive. For every £1 earnt, 60 pence are paid to the exchequer. Fortunately, there are several ways of avoiding or mitigating the 60% Tax Trap Band:

- Increase the amount paid into your pension

- You can receive tax relief on money saved into a private pension scheme, up to an annual allowance of £40,000. The allowance is reduced to a minimum of £4,000 if you earn high income or have flexibly accessed your pension.

- Ask for a non-cash bonus

- If you are not in need of liquidity immediately, then rather than receiving a cash bonus, you can ask for a non-cash bonus provided at low or no tax if received through a salary sacrifice scheme. Consider a company car with low emissions, childcare or private medical insurance.

- Invest in start-up investment schemes

- There are three start-up schemes you can invest in which give you a percentage of your investment back as tax relief: Seed Enterprise Investment Scheme (SEIS) – 50%, Venture Capital Trust (VCT) – 30% and Enterprise Investment Scheme – 30%. Speak to your adviser about building a portfolio which balances your appetite for risk and reward.

- Donate to charity and claim Gift Aid Tax Relief

If you anticipate that your income will exceed £100,000, talk to your employer about strategies to manage your tax position. As ever, Contact Mouktaris & Co Chartered Accountants for expert advice or click here to subscribe to our Newsletter.

One Entertains: Tax Allowances for the Platinum Jubilee (and other Entertainment)

With the dust still settling on the Mall following a triumphant celebration of Her Majesty The Queen’s Platinum Jubilee, one may begin to consider the tax deductibility of hosting Diana Ross, Ed Sheeran and the like – a figure reported to be around £28m.

As a general rule for tax, expenditure on entertainment or gifts incurred in the course of a trade or business is not allowed as a deduction against profits, whether incurred directly or paid to a third party such as an events organiser. HMRC are not however completely devoid of holiday spirit and provided conditions are met, certain types of entertainment are allowable. Hurrah.

Promotional Events

Events which publicise a business’ products or services are not deemed to be entertaining expenditure and so direct costs are allowable for tax if they meet the “wholly and exclusively” test. The cost of related food, drink or other hospitality is however disallowed. For example if a car manufacturer organises a golf day at which test drives are available, only the direct costs of the test drives and of any publicity material provided are allowed, together with any immaterial costs such as teas and coffees.

Gifts

Costs are allowable where gifts incorporate a conspicuous advertisement, do not exceed £50 in value (for all gifts made to the same recipient in a year) and are not food, drink, tobacco or tokens or vouchers exchangeable for goods. This could be merchandise branded with the business logo.

Staff Entertainment

Entertaining staff is allowable provided that it is not merely incidental to customer entertaining. Regardless of any deduction allowed against the profits of the business, a tax charge may arise on the employee personally. Employers may need to report the event costs to HM Revenue & Customs (HMRC) on each employee’s form P11D and pay class 1A National Insurance. Generous employers can though opt to pay the Income Tax and National Insurance Contributions on behalf of employees by entering into a PAYE Settlement Agreement (PSA).

To avoid this complicated scenario and to ensure that staff entertainment is allowable, an event would need to meet the following conditions:

- Opening the party to all staff (not only to directors/management)

- Limiting the cost per staff member to £150 per head (inclusive of VAT) per year. In practice, this would mean limiting the cost per general attendee to £150 per head. One would also need to consider any future events in which the limit may be breached, for if the cost per head were to exceed £150, then no tax-deductible expense could be claimed, with a tax charge arising on employees.

To avoid a tax charge, the event would need to meet the additional condition of taking place annually! If an event were to include entertainment for staff as well as customers, the apportionment of expenditure on staff would be fully allowable, whilst the apportionment of expenditure on clients would generally be disallowable (with the exception of any gifts).

Recovering VAT on Entertainment

As a general rule, a business cannot recover input VAT related to client entertainment. VAT incurred on staff entertainment is however recoverable provided the following conditions are met:

1. Entertainment is not only provided for directors/partners

2. Costs incurred are not related to entertaining non-employees. For events which entertain both employees and non-employees, an apportionment of employee-related expenses and VAT would again be made.

Contact Mouktaris & Co Chartered Accountants for expert advice or click here to subscribe to our Newsletter.

Spring Budget 2022

A Targeted Budget

Amid soaring inflation of 6.2% and forecasts of the sharpest fall in living standards since records began (according to the UK’s fiscal watchdog), Rishi Sunak presented a Budget which he argued would support the UK economy, businesses and families in both the short and the medium term. In contrast to the profligate Budgets of very recent times, which were arguably necessary to address a pandemic that affected all areas of the economy from all angles, this was a targeted Budget with a laser beam pointed at the erosion of disposable incomes that is likely to pursue at least in the short term.

The key measures were as follows:

- regarding personal taxes, an increase to the threshold at which an individual will begin to pay NI from 6 July 2022, aligning it with the personal allowance which is set at £12,570 per annum

- regarding employment taxes, the Employment Allowance will be increased by £1,000 from 6 April 2022 to £5,000

- regarding duties, an immediate reduction in duty on diesel and petrol, by 5 pence per litre, for 12 months

- regarding VAT, a cut in the VAT levied on energy efficient upgrades, such as solar panels and energy efficient heating

Rishi Sunak saved the “crowd pleaser”, or “low-tax-Conservative-MPs-and-commentators pleaser” until the end – his virtual rabbit out of the hat, by promising to cut the basic rate of income tax to 19p in the pound in April 2024, conveniently a few weeks before many Tory MPs expect to face a general election. Rishi has kept what looks to be substantial powder for more election-fighting fireworks. Has he done enough for the poorest people in society? Having banked most of the fiscal good news he received – higher than expected growth and tax revenues this year – he could have gone further. He is building up a war chest for the autumn. Momentum politics.

Contact Mouktaris & Co Chartered Accountants for expert advice or click here to subscribe to our Newsletter.

EIS Tax Relief for Joint Investment

The following scenario often arises with our client Mr Investor, who is considering investing in an early-stage business. Wonderful Ltd is an established FinTech company which has developed a track record of an established user base, consistent revenue figures and other key performance indicators. Wonderful Ltd is now seeking to raise Series A funding of £1.5 million in order to further optimize its user base and product offerings. Mr Investor has received an Investment Memorandum for the funding round and is considering allocating a small proportion of his investment portfolio. Mr Investor has asked his accountant to run through the Investment Memorandum with him and has identified five reasons why he wishes to invest. Being an early-stage business, Mr Investor acknowledges that the investment is inherently high-risk, but he really believes in the founder Mrs Wonderful, who attended the same university. The generous Enterprise Investment Scheme (EIS) tax breaks “cushion” the risk element of the investment (see below) but nonetheless, the minimum investment of £75,000 is punchy for Mr Investor.

Mr Investor has an idea. Can he pool together capital from two other friends in order to meet the £75,000 minimum investment? Will each investor still be eligible for the EIS tax relief for joint investment?

Joint Investment – A Problem Shared is a Problem Halved

In short, there is a way to pool funds in order to meet one investment clip of £75k. EIS relief is available for an individual who makes the subscription on his or her own behalf, with two notable exceptions:

- Individuals who use another person as a nominee to subscribe for the shares, or be registered as the holder of them, on their behalf, are treated as themselves being the subscriber.

- Individuals who invest jointly with others, with the result that the subscribers are in law acting as bare trustees (whether for themselves or for others), are themselves as individual beneficiaries treated as being the subscribers.

Mr Investor can therefore form a bare trust with his friends (as in point 2) in order to make a direct investment jointly. Where shares are issued to a bare trust on behalf of a number of beneficiaries, each beneficiary is treated as having subscribed, as an individual, for the total number of shares issued to the bare trustees divided by the number of beneficiaries. This creates an important limitation in that each of the three friends should invest an equal percentage in Wonderful Ltd.

Paperwork

Wonderful Ltd should provide each subscriber form EIS3 showing the total number of shares subscribed for on Page 1 of the form. Form EIS3 Page 3 should show the amount on which each owner is entitled to claim the tax relief for the shares, that is the fractional amount of the total subscribed.

Tax Relief?

Whilst joint investment does not preclude EIS tax relief, Mr Investor and his associates must of course check that all the other EIS eligibility criteria are met for EIS tax relief to apply. Mouktaris & Co can provide a checklist of questions to ask in order to determine whether tax relief under EIS is available to an investor in shares. The target company may produce an Advance Assurance document to potential investors demonstrating that HMRC accepts the investment under the scheme, however Advance Assurance will not tell you if an investor would meet the conditions of the scheme.

EIS Investment Funds

A different route (via point 1 above) would be for Mr Investor to invest via an EIS investment fund, which is structured as a nominee vehicle which invests funds in EIS-qualifying companies on behalf of investors. This vehicle would provide Mr Investor with a more diversified risk exposure to early-stage businesses, as his £25,000 investment would be spread across a number of target companies identified by the fund manager. Wonderful Ltd may seek to market its strengths to the EIS investment fund manager so as to be included in the fund’s equity holdings. So in fact Mr Investor could in the future invest in Wonderful Ltd through an EIS investment fund without necessarily being reliant on his friends’ capital.

EIS for Investors: Advantages

- As a reminder, EIS investors receive the following benefits as a result of participating in the scheme:

- A 30% income tax break against the amount invested

- No capital gains tax (CGT) to be paid on any profit arising from the sale of the shares, as long as they are held for at least 3 years

- Payment of CGT can be “rolled over” if the money gained is invested through EIS. The investment must be made 1 year before or 3 years after the gain occurred

- No inheritance tax is payable provided shares are held for at least 2 years

- If the shares are sold at a loss, the loss can be offset against any income tax in that year or the previous year

Whether you’re an existing client or don’t yet use our services, we would be pleased to help you. Contact Mouktaris & Co Chartered Accountants for expert advice or click here to subscribe to our Newsletter.

Wealth Tax?

Calls for a wealth tax have so far been made with little impact, amid fears that a levy on assets would not go down well with conservative – or even not-so-conservative voters, and could hurt people with valuable homes but little cash. However, the Wealth Tax Commission said the timing was ripe for radical change due to the devastating impact of Covid on the public finances and on inequality in Britain.

The Wealth Tax Commission was established in Spring 2020 to ‘provide in-depth analysis of proposals for a UK wealth tax’. It’s not a government body, but a ‘think-tank’ funded by the London School of Economics, Warwick University and the Economic and Research Council (itself a public body). The Commissioners comprise a senior academic from the LSE and Warwick university and a very well-known tax barrister.

Whilst conclusions published last week may therefore not directly reflect government policy, they do propose an academic and practical solution to shore up public finances in these times of crisis – and should be afforded some serious attention. Readers may consult the full 126-page report here. For those with less time, the key points are below.

The report does not argue for the idea of an annual wealth tax. However, it’s strongly in favour of the levying of a wealth tax on a one-off basis to deal with an exceptional need – being that of repairing the alarming hole in public finances caused by coronavirus. The basic premise is therefore based not on redistribution but pragmatism – and the best place to get the money is from people who have it.

Interestingly, that pragmatism contrasts with the reasons that people who support the idea of wealth tax give for doing so: ‘filling a hole in public finances’ comes in only at fourth place, after ‘the gap between rich and poor is too large’; ‘the rich have got richer in recent years’; and ‘better to tax wealth rather than income from work’.

The report leans on a simplified design and implementation to maximise the efficacy of the tax – with the scope to avoid the net limited to such matters as redistribution, relocation or releveraging – all within a potentially short period of time.

How do the Commissioners propose a Wealth Tax should work?

- It should be levied at the same rate on all assets including the family home, businesses and pension funds. Special reliefs or exemptions would reduce the efficacy of the program by decreasing the yield, complicating the administration and affording opportunities for avoidance.

- It should be levied by reference to wealth as at a single ‘assessment date’ with only very limited scope for reassessment or revision of the tax should there subsequently be a dramatic fall in value.

- There would be the option to pay the tax over five years, with further deferral possible in defined circumstances of illiquidity. Payment of tax in respect of pension fund wealth would automatically be deferred until retirement.

- There should be little or no advance warning of the implementation of the tax, so as to minimise the effect of ‘forestalling’ or advance planning.

- The tax should, broadly, be levied on people who are tax-resident in the UK on the ‘assessment date’ and by references to assets whether in the UK or overseas. But special rules would apply to both recent arrivals in the UK and to people who had left the UK shortly before the ‘assessment date’.

- Non-residents would be liable only in respect of UK real property.

- Trust assets would be included if the settlor or a beneficiary was UK-resident at the ‘assessment date’.

- The assets of minor children would be aggregated with those of parents. Spouses and civil partners could elect to be taxed as a unit.

- At thresholds of £500,000, £1m and £2m per person, a wealth tax would respectively cover 17%, 6%, and 1% of the adult population. An illustrative rate of 1% at a threshold of £1 million per household (assuming two individuals with £500,000 each) would raise £260 billion over five years after administrative costs.

Whether you’re an existing client or don’t yet use our services, we would be pleased to help you. Contact Mouktaris & Co Chartered Accountants for expert advice or click here to subscribe to our Newsletter.