Tag: Accountants North West London

Coronavirus: Latest version of the Furlough Scheme

On 5 November, the Chancellor announced that the CJRS would be extended until the end of March 2021 for all parts of the UK. Employers want to know the details announced yesterday, as employees hope this will be enough to secure their jobs.

HMRC has circulated a short round-up explaining the impacts of this and where to find more information. The new and updated collection of advice notes can all be accessed from a single page: gov.uk/government/collections/coronavirus-job-retention-scheme.

What’s happening

CJRS has been extended to 31 March for all parts of the UK. From 1 November, the UK Government will pay 80% of employees’ usual wages for the hours not worked, up to a cap of £2,500 per month. Employers will continue to pay for hours worked as normal. The Government will review the policy in January.

Who is eligible

Employers and their employees do not need to have used the scheme before to claim for periods from 1 November. Employers can claim for employees who were employed on 30 October 2020, as long as a PAYE RTI submission was made to HMRC between the 20 March 2020 and 30 October 2020, notifying a payment of earnings for that employee.

Reference pay

All employees on an RTI submission on or before 19 March 2020 will be able to use the CJRS calculations as applied in August 2020 for reference pay and usual hours. For new employers claiming and new employees hired between 20 March 2020 and 30 October 2020, the average of tax year 2020 to 2021 up to the start of the furlough provides the basis for calculation (for fixed pay employees its the last pay period prior to 30 October 2020).

Legal matter

Employers should discuss with their staff and make any changes to the employment contract by agreement. To be eligible for the grant, employers must have confirmed to their employee in writing that they have been furloughed. Our clients can contact our office and we will provide you with a template agreement.

Compliance and monitoring

HMRC intend to publish details of employers who use the scheme for claim periods from December, and employees will be able to find out if their employer has claimed for them under the scheme.

Further updates

- As a consequence, the Job Support Scheme will start on 1 April 2021 at the earliest

- It also means that the £1,000 Job Retention Bonus will now not be paid in February 2021. The government said they will redeploy a retention incentive at the appropriate time.

- The Self-Employment Income Support Scheme (SEISS) grant for November-January will cover 80% of average monthly trading profits, paid out in a single instalment covering three months’ worth of profits, and capped at £7,500 in total. This is an increase from 55% and £5,160 respectively, previously announced.

- As of 2 November, application deadlines have been extended until 31 January 2021 for the:

- Bounce Back Loan Scheme

- Coronavirus Business Interruption Loan Scheme

- Coronavirus Large Business Interruption Loan Scheme

- Future Fund

- Covid Corporate Financing Facility

The extended generosity by the government comes at a cost. How precisely all of the various coronavirus schemes will be financed is highly uncertain.

Whether you’re an existing client or don’t yet use our services, we would be pleased to help you. Contact Mouktaris & Co Chartered Accountants for expert advice or click here to subscribe to our Newsletter.

Coronavirus: additional schemes and updates

Chancellor Rishi Sunak has vowed to “go further” as he announced the government’s latest Plan for Jobs: three new measures to help workers and businesses get through lower demand over the winter due to a coronavirus second spike. The most significant announcements concern the Job Support Scheme (JSS), which will be made up of two parts: JSS Open and JSS Closed. Both will start on 1 November, the day after the Coronavirus Job Retention Scheme (CJRS) finishes, and run for six months.

JSS Open

JSS Open will provide support to businesses that are open where employees are working shorter hours due to reduced demand.

- Employees will need to work at least 20% of their usual hours and employers will continue to pay employees for the hours they work.

- For the hours not worked:

- The UK government will pay a contribution of 61.67% of the usual pay, up to a maximum of £1,541.75 per month.

- Employers will pay 5% of the usual pay, up to a maximum of £125 per month, and can top this up further if they choose.

- Employees should receive at least two thirds of their usual pay for hours not worked, where they earn £3,125 a month or less.

- Employers will need to cover all employer National Insurance and pension contributions.

When JSS was originally announced, the government’s and the employer contribution to wage costs was to be one third each of the hours not worked.

JSS Closed

JSS Closed will provide support to businesses whose premises are legally required to close as a direct result of coronavirus restrictions set by one of the four governments of the UK. This includes premises restricted to delivery or collection-only services from their premises, and those restricted to providing food and/or drinks outdoors.

For JSS Closed, the UK government will fund two thirds of employees’ usual wages for time not worked, up to a maximum of £2,083.33 per month. Employers will not be required to contribute, but they can top up the government’s contribution if they choose to. Employers will still need to cover all employer National Insurance and pension contributions.

Self-employment Income Support Scheme (SEISS) Grant Expansion

It was previously announced that SEISS would cover 20% of monthly profits for the period from November 2020 to January 2021, capped at £1,875 in total. The UK government is now doubling the value of the first grant to 40% of three months’ average trading profits, paid out in a single instalment, and capped at £3,750. HMRC will provide full details about claiming and applications in mid-November. The second grant will cover a three-month period from the start of February until the end of April. The government will review the level of the second grant and set this in due course.

Grants for businesses in Tier 2 and Tier 3 Areas

Businesses in England in Very High alert level areas (Tier 3) will now be able to claim grants, regardless of whether they are legally required to close or remain open. The grant will be:

- £1,300 per month for businesses occupying a property with a rateable value of less than £15,000

- £2,000 per month for businesses occupying a property with a rateable value of less than £51,000 or occupying a property or part of a property with annual rent or mortgage payments of less than £51,000

- £3,000 per month for businesses occupying larger properties

Hospitality, hotel, B&B and leisure businesses in England in High alert level areas (Tier 2) will now also be able to claim grants. The grant will be:

- £934 per month for businesses occupying a property with a rateable value of less than £15,000

- £1,400 per month for businesses occupying a property with a rateable value of less than £51,000

- £2,100 per month for businesses occupying a property with a rateable value of greater than £51,000

Businesses in other sectors may also be eligible at the local authority’s discretion and we urge our clients to maintain communication with their local authority where possible, as discretionary grants are often made available at short-notice.

Businesses in any area which has been under enhanced restrictions can backdate their grants to August.

Whether you’re an existing client or don’t yet use our services, we would be pleased to help you. Contact Mouktaris & Co Chartered Accountants for expert advice or click here to subscribe to our Newsletter.

Winter Economy Plan

Chancellor Rishi Sunak today delivered a statement setting out plans to help workers and businesses hit by new coronavirus restrictions. With plans for an Autumn 2020 Budget cancelled, the Chancellor announced his Winter Economy Plan. In it he outlined how the various government support schemes to help businesses through the coronavirus restrictions will be extended or remodeled.

Job Support Scheme

As now anticipated, the introduction of the new Job Support Scheme (JSS) will come into effect on 1 November after the Coronavirus Job Retention Scheme (CJRS) ends. Under JSS, which will last for six months, employees who work at least 33% of their hours will be paid for two thirds of the hours they do not work, shared equally between the employer and the government.

The result is that an employee working 33% of their normal hours will receive 77% of their pay: 55% paid by the employer and 22% paid by government.

Other measures

- The self-employed grant is extended on similar terms to the JSS. A grant will be available to those eligible for the Self Employment Income Support Scheme (SEISS) and will cover 20% of monthly profits for the period from November 2020 to January 2021. A further grant to cover February 2021 to April 2021 may become available, depending on circumstances. [22/10/2020 UPDATE]: In his third economic statement within the last month, the Chancellor confirmed more generous terms for the remaining SEISS grants. The level of the third grant will be based on 40% of average trading profits, rather than the previously announced 20%, and will be capped at £3,750. The level of the fourth grant is to be kept under review and announced in due course. [Subsequent UPDATE]: The Chancellor confirmed once again even more generous terms for the remaining SEISS grants. The level of the third grant will be based on 80% of average trading profits, rather than the previously announced 20% then 40%, and will be capped at £7,500.

- Businesses that deferred a quarterly VAT payment during the lockdown previously had to pay this back by 31 March 2021 – now they will be able to spread this over 11 months during 2021/22. Businesses will need to opt in, but all are eligible.

- Individuals who deferred their July 2020 self-assessment tax liabilities till January 2021 will now not need to pay that till January 2022. Taxpayers with up to £30,000 of Self-Assessment liabilities due, including liabilities that will become due in January 2021, will be able to use HMRC’s self-service Time to Pay facility to secure a plan to pay over an additional 12 months. Any Self-Assessment taxpayer not able to pay their tax bill on time, including those who cannot use the online service, can continue to use HMRC’s Time to Pay Self-Assessment helpline to agree a payment plan.

- The VAT reduction to 5% for the hospitality sector will be extended from 12 January 2021 to 31 March 2021.

- The extension of Coronavirus Business Interruption Loan Scheme (CBILS) and Bounce Back Loan Scheme (BBLS) loans from six to ten years.

- BBLS loans will become known as “Pay as You Grow” – businesses will enjoy a flexible repayment system which will include interest-only periods of up to six months and payment holidays.

- Applications for new loans under BBLS, CBILS, the Coronavirus Large Business Interruption Loan Scheme and the Future Fund remain open till the end of November 2020.

Whether you’re an existing client or don’t yet use our services, we would be pleased to help you. Contact Mouktaris & Co Chartered Accountants for expert advice.

Technology and Professional Services Grant for SMEs

The government has announced details of new funding, designed to help small and medium sized businesses (SMEs) access technology and advice. SMEs will have access to grants of between £1,000 – £5,000 to help them access new technology and other equipment as well as professional, legal, financial or other advice to help them get back on track. The programme is due to launch in September.

Funds could be deployed to help businesses in the following ways:

- Advice on implementing technologies to streamline operations, for example apps to organise rotas and reporting for staff

- Equipment to facilitate efficiencies, including with respect to financial reporting or continuing to deliver business activity in response to COVID-19

- Legal advice regarding getting back on track and managing stakeholders, including HR

- Professional advice to review business strategy or business models

- Coaching and mentoring in leadership and management development

- Innovation strategy to adapt and diversify products or services

- Developing or revising marketing or digital strategies to reach new markets

- Mitigating the impact of social distancing measures

- Legal and environmental health compliance

- Skills analysis and development plans

- Employee engagement, welfare and wellbeing

Mouktaris & Co provide many of the services which will be eligible for this support, including accountancy services, business advice, legal services and HR support. If you have considered a project or initiative to develop your business, the grant program may be suitable for you. You can access the funding – provided by the England European Regional Development Fund – as part of the European Structural and Investment Funds Growth Programme 2014-2020, through 38 growth hubs within a Local Enterprise Partnership (LEP) area. If you are interested in support, advice or funding associated with your business venture, please contact your nearest LEP growth hub.

Further information

- The support will be fully funded by the Government with no obligation for businesses to contribute financially.

- Amongst other eligibility criteria, a business must have been trading on or before 1st March 2019 and should still be trading.

- The grant must cover 100% of the service a business is procuring (up to a maximum total project value of £5,000). The grant cannot be used to part-fund expenditure.

- Grants must be claimed within one month of receiving confirmation that the application has been accepted and upon production of an invoice for the claimed service or goods.

- Growth Hubs work across the country with local and national, public and private sector partners – such as Chambers of Commerce, FSB, universities, Enterprise Zones and banks, coordinating local business support and connecting businesses to the right help for their needs. They are locally driven, locally owned and at the heart of the government’s plan to ensure business support is simpler, more joined up and easier to access. A Growth Hub will therefore encourage you to utilise specialist advice from a local supplier.

- The funding being provided to businesses is supported by the England European Regional Development Fund as part of the European Structural and Investment Funds Growth Programme 2014-2020. The funding has been allocated to Growth Hubs within each LEP area in line with the current ERDF Programme.

Whether you’re an existing client or don’t yet use our services, we would be pleased to help you. Contact Mouktaris & Co Chartered Accountants for expert advice, including ideas on deploying funds to help your businesses grow.

Professional Services Firm: LLP or LTD

We are often asked to advise our Professional Services clients, lawyers and accountants, on the optimal business structure: LLP or limited company (LTD).

Whilst the statutory and accounting filing requirements are similar across both structures, the LLP was introduced to offer flexibility in management and pay: both important in human-capital-intensive Professional Services Firms. An LLP is controlled by its Members and governed by the Members Agreement, whilst a company is controlled by its shareholders under the articles of association and shareholders’ agreement.

Soon after their introduction, LLPs became the go-to model for Professional Services Firms because of the ability to:

- split partnership profits between Individual Members, taxed at income tax rates, to reflect profit or performance targets;

- appoint a Corporate Member to absorb “excess partnership profits” in a given financial year, taxed at a lower (corporation) rate of tax and available for reinvestment in the business;

- appoint and remove partners without the complex process and costs of them conferring or relinquishing shareholdings, and without the tax costs were any shares obtained at undervalue.

Tax

We know that LLPs are tax transparent and that Individual Members are usually treated as self-employed and taxed at income tax rates, subject to HMRC tests. On the contrary, a company pays corporation tax on profits: a company’s directors receive salaries subjected to PAYE whilst its shareholders pay income tax on dividends voted by the directors.

Some of the benefits of an LLP therefore centre around the following:

- An Individual Member of a trading LLP is taxed as if they are carrying on a trade directly for income tax purposes. This treatment carries certain tax advantages compared to the treatment of employees:

- Expenses are generally deductible for tax purposes if they are wholly and exclusively incurred for the purposes of the trade. This is in comparison to wholly, exclusively and necessarily incurred for employees.

- Pay as you earn (PAYE) does not apply and tax is generally only payable twice yearly rather than monthly as the individual members are not employees.

- Employer national insurance contributions (NICs) (currently 13.8%) are not payable in respect of the amounts payable to the individual members of the LLP as they are not employees.

- Members can flexibly adjust how the LLP is governed as Members arrive and leave and how Members are remunerated.

Pre-2014: LLP the way to be

Previously and in accordance with a Profit Sharing Agreement (part of the Members Agreement), LLPs enjoyed the ability to apportion taxable profits between Individual Members and Corporate Members, who pay contrasting rates of tax (sometimes 45% vs 19%). LLPs proved to be an effective structure for the governance of a Professional Services Firm, whilst also offering a “hybrid model” of taxation, whereby Individual Members were taxed at income tax rates on income drawn and presumably spent, whilst Corporate Members were taxed at a lower corporation tax rate on excess profits retained for capital expansion of the business.

Post-2014: LLP attack

The mixed membership partnerships anti-avoidance legislation of Finance Bill 2014 brought about a significant change in partnership taxation. Leading up to the change in law, it had become relatively common to see partnerships (including LLPs) with mixed Individual and Corporate Members. In short, the legislation provided for profits allocated to a non-individual partner (B) in a mixed member partnership to be reallocated to an individual partner (A), such that they are taxed at the individual partner’s rate of tax, if either:

- Condition X: it is reasonable to suppose that:

- B’s profit share includes an amount representing A’s deferred profit; and

- A’s profit share and the total amount of tax for which A and B are liable (relevant tax amount) are lower than they would have been absent the deferred profit arrangements.

- Condition Y: B’s profit share exceeds the appropriate notional profit, A has the power to enjoy B’s profit share and it is reasonable to suppose that:

- B’s profit share (or part of it) is attributable to A’s power to enjoy; and

- A’s profit share and the relevant tax amount are lower than they would have been absent A’s power to enjoy in B’s profit share.

Almost overnight, the mixed membership partnership rules led to a decrease in the popularity in the use of LLPs with Corporate Member structures amongst the SME business community and in some cases the unwinding of existing LLP structures.

Action

For mixed partnerships, the following steps could be considered:

- Outright incorporation. This clearly removes the issue of reallocation and provides a deferral of higher tax rates while the company retains the profits.

- Eliminate the corporate members and accept the income tax result. This in effect concedes the full impact of the new rules, so could be combined with exploring other approaches.

- Establish a company owned by the partnership to operate the business with or without the capital assets, ie the corporate is a subsidiary, not a partner. This may provide a possible solution in allowing ownership to change in a partnership rather than a share capital company, but with suitable profit retention for working capital by the operating company.

- Retain the existing structure with corporate members’ shares in amounts that can be justified by the new rules for services or the provision of capital.

- Consider the use of alternative business structures which should not result in reallocations between partners. These require specialist consideration by reference to the case and a range of other relevant legislation.

Clearly the tax effects of making a change will need full review, such as the availability of incorporation relief from capital gains tax, stamp duty land tax, and the impact of entrepreneurs’ relief. You can rely on our expertise surrounding companies, partnerships and tax for the delivery of the sound ideas needed to put plans into action:

- We help businesses manage all aspects of structure from set-up and management to dispute resolution and exit strategies

- We look at tax structures

- We understand the differences in structure between a partnership and a company;

- We advise on adapting a structure that is no longer fit for purpose.

Contact Mouktaris & Co Chartered Accountants for help planning your Professional Services Firm expansion.

How to Invest Business Profits

With many entrepreneurs accumulating cash in business accounts, the question of “how to invest business profits?” is a favored topic when planning.

Entrepreneurs work hard for their businesses and this short article explores how business funds can work hard- or most effectively, for entrepreneurs.

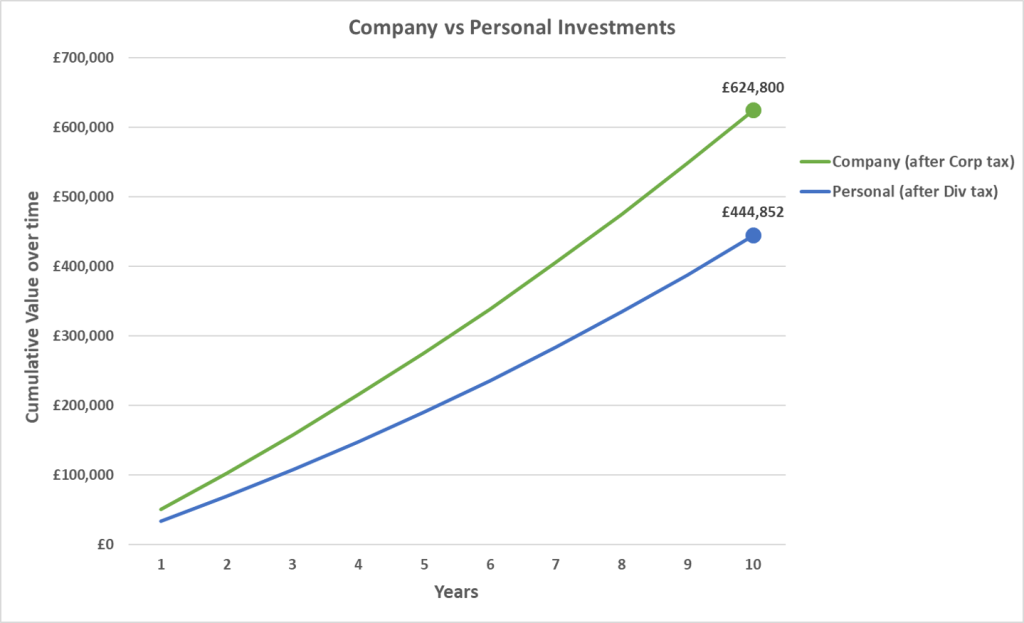

Let’s take the following scenario: your business is profitable and has accumulated cash. During the years of trading, you have typically drawn an annual salary and dividends of £45,000, a point at which you are paying the basic rates of tax. Now with a stockpile of cash in the business, there are two options through which to invest. Should you personally draw additional funds from the company to invest, or alternatively should you invest from within the corporate structure?

Assume in both cases there is a £50,000 cash surplus in the company. Assume also that this happens every year for the next 10 years.

Personal investment through your ISA

To take the money out of the company, you would pay dividend tax of 32.5% upfront. You (and perhaps your partner) could then invest your money tax-free, say in an ISA wrapper, in which your combined ISA allowances are currently £40,000.

Investment through your Company

Investing the money within the company would mean no upfront dividend tax of 32.5%. You would instead pay corporation tax on the investment income and gains annually, with the caveat that dividends received from stocks and shares are mostly exempt from corporation tax. This is a considerable advantage.

Let’s see how the two strategies fare:

As you can see, investing the money in a limited company yields approximately £180,000 more over a ten-year time horizon. The cost of paying the dividend tax upfront outweighs the benefit of tax-free personal investments. Why should you lose out?

Compounding evidence

You will notice immediately from the graph above that investing your company’s profits in the corporate vehicle, without paying dividend tax, allows the investment to accumulate, or compound, at a faster rate, even after paying corporation tax on investment income and gains.

Sure, if you do not draw the surplus funds from your company you may need to take a 32.5% dividend tax rate hit at a later date, but in the interim you will have generated greater income through compounding.

Caveats

Here we assume constant tax rates at the points of execution, income and realisation. It would be unwise to speculate on domestic policy, but current political trends and economic philosophy may see a conservative government try to enforce its stronghold on previously labour heartlands. Corporation and dividend tax rates could well rise before they fall.

You may find that transaction costs are slightly higher for corporate accounts, chipping away at annual returns. You will need to shop around harder for a broker. Equally personal brokerage accounts tend to be more insurable than corporate accounts.

Investing through a Limited Company

If the preference for investing through a Limited Company has been established, so should the mechanism through which to do so. Yes, you could simply open an investment account for the existing trading company, however there are several reasons why a designated investment company is superior:

- If the trading company runs into legal issues, the investment company will be protected.

- The trading company can be sold off as a standalone vehicle without the need for complex restructuring.

- An investment company will have minimal expenses and overheads, meaning it will be easier to administer for tax purposes (no VAT or payroll requirements).

- A trading company shouldn’t start investing in activities outside its core functions as it could end up becoming reclassified. This may carry tax implications, especially if Entrepreneurs’ Relief is sought.

Whilst the trading company is often the vehicle in which profits have been generated and accumulated, there are tax neutral ways of shifting funds to an investment company, such as lending the cash surplus. There is no obligation to pay back the loan and one can be the sole director of both companies.

A Holding Company

A holding company structure that owns operating companies and receives dividends is favourable. The holding company can own shares in the subsidiary trading companies and can provide centralised corporate control. Additionally, no taxes would be incurred when the trading company is sold.

Special Purpose Vehicle (SPV) for Property

If you want to invest in property it may be a better idea to set up an SPV. This is often a requirement from buy-to-let lenders. If you are looking to acquire a primary residential residence however, personal ownership is often the best way to go.

Don’t let the tax tail wag the investment dog

Your investment goals will seek a level of risk and return that you are comfortable with, regardless of the structure through which you pursue them. The tax wrapper is the “cherry on the top”, though worth a certain percentage of your annual returns. Contact Mouktaris & Co Chartered Accountants for an accountant who understands your investment strategy and can help you plan accordingly.

Non-resident Taxation of Income from UK Property

Finance Act 2019 has introduced two changes to the taxation of non-resident income from UK property:

- From 6 April 2019, disposals of direct or indirect interests in UK land are brought into the Territorial scope of charge; and

- From 6 April 2020, income from a UK property business is moved out of the charge to income tax and brought into the charge to corporation tax.

Background: the position until 5 April 2020

Non-UK resident companies have been subject to income tax in respect of property income arising in the UK. Tax has been chargeable at the basic rate of 20%. These companies are required to complete a Non-resident Company Income Tax Return (SA700).

Finance Act 2019

Coming into effect from 6 April 2020, income from a non-resident UK property business will now be subject to corporation tax rather than income tax. The corporation tax rate is currently charged at 19%: 1% point lower than the equivalent income tax rate. The details of profits to be charged with corporation tax will be included on a company tax return form CT600, as opposed to the SA700.

From an administrative point of view, the annual company tax return will include details of both UK property business income and any property disposals for the accounting period as a whole, on which corporation tax will be due. The filing deadline is 12 months after the end of the accounting period, though in practice, this will be filed 9 months after the end of the accounting period: the point at which any corporation tax is due.

Property losses and allowable deductions

Profits and losses will accordingly be drawn up under corporation tax principles according to the rules of CTA 2009 Part 4.

Loan relationships or derivative contracts that the non-resident company is party to for the purposes of its UK property business are also brought into the charge to corporation tax.

For companies that have net deductible interest and financing costs of over £2 million per annum, there will be a limit to the amount that the company can deduct: the Corporate Interest Restriction.

Transitional rules

UK property business income tax losses carried forward at the point of transition, 6 April 2020, will be grandfathered and therefore deductible under corporation tax rules against future income of the property business.

Capital allowance balances will transfer between the two regimes in such a way as to produce no balancing allowances or charges.

Notably, if a company’s only source of UK income after 6 April 2020 is expected to be income from the UK property business, no Income Tax payments on account for 2020/2021 and future tax years will be required. Similarly, if a credit balance remains in the company’s Income Tax account after all Income Tax liabilities for 2019/2020 and earlier years have been settled, the credit balance will be repaid to the company.

Annual Tax on Enveloped Dwellings (ATED)

ATED on residential properties owned through a corporate structure with a value of more than £500,000 continues to be unchanged following the Finance Act 2019. As ever, ATED can be relieved in full for residential property that is let to a third party on a commercial basis and isn’t, at any time, occupied (or available for occupation) by anyone connected with the owner. Other reliefs can be claimed as per sections 30 to 41 of the ATED technical guidance.

Capital Gains Tax (CGT) on UK property

Non-residents, both individuals and companies, are taxed on almost all gains made on disposals of UK residential properties. Since 6 April 2019, non-UK residents who make an indirect disposal of an interest in UK land will also be brought into the Territorial scope of charge, with the new s1A of TCGA 1992 Part 1. Indirect disposals can for example be disposals of shares in a non-UK entity that derives at least 75% of its value from UK land, provided that the person making the disposal has an investment of at least 25% in that company. The scope of taxation for non-residents has been extended from targeting UK residential property specifically, to now including commercial property and disposals of shares in so-called ‘property rich’ entities. Disposals will be reported in the annual company tax return.

Mouktaris & Co have experience in helping clients navigate the regulatory, accounting and tax matters of property businesses. Our team can review your corporate structure and advise on whether it may be beneficial to de-envelope or restructure in other ways, to take heed of an almost even UK vs non-UK playing field. This will include reviewing potential capital gains tax, stamp duty and inheritance tax liabilities as well as commercial considerations of raising finance and banking relationships in the UK and offshore.

Contact Mouktaris & Co Chartered Accountants to find out how we can help your property rental business.

Accountant’s Report for Estate and Letting Agents

NALS rebrands as Safeagent

As of the 17th May 2019 the National Approved Letting Scheme (NALS), the UK’s leading accreditation scheme for lettings and management agents operating in the private rented sector, rebranded as Safeagent. Previously NALS and Safeagent were two separate brands. Safeagent, with the assistance of NALS since 2011, was focused on achieving mandatory Client Money Protection (CMP) for all lettings and management agents. NALS was an independent, not-for-profit accreditation scheme for agents, which has been operating for 20 years. Given that NALS and Safeagent shared the same goal of consumer protection, the decision was taken to merge the two brands, and trade under the one Safeagent name.

To become accredited with Safeagent, a firm must comply with the 4 Safeagent client accounting standards:

- Maintain separate client accounts.

- Withdraw from client accounts only under certain circumstances outlined by Safeagent.

- Record Keeping: maintain proper internal accounts showing the up-to-date position in relation to standards 1 and 2.

- Reporting: provide a declaration by an accountant confirming that the firm has bookkeeping procedures in place for handing clients’ money.

Mouktaris & Co have experience in helping clients with the regulatory, accounting and tax matters of property investment, sales and lettings. Our team can review your information system and records in order to produce reports required under the Association of Residential Letting Agents (ARLA) Byelaws, the Estate Agents (Accounts) Regulations 1981 (EAAR) and the National Association of Estate Agents (NAEA). We can also provide reports required for Safeagent, RICS and ARMA regulated firms.

Contact Mouktaris & Co Chartered Accountants to find out the many other ways we can help your business, including bookkeeping services, management accounts and advice on internal controls.

Offshore Income: in the Firing Line of the Worldwide Disclosure Facility

As predicted, HM Revenue & Customs (HMRC) has started firing, quite unpredictably, Certificates of tax position concerning offshore income or gains. In the firing line are taxpayers who the revenue believes have not correctly disclosed their worldwide income to HMRC. The requirement for a UK resident to disclose and pay tax on all overseas income and gains is age-old, but was often overlooked: clouded by the murky waters that separated national tax positions. Now the gunpowder, or information source, are the Common Reporting Standards (CRS), a commitment by over 100 countries to exchange taxpayer information on a multilateral basis and increase international tax transparency.

Past, Present or Future?

Taxpayers are being encouraged to use HMRC’s Worldwide Disclosure Facility (WDF) to come clean and disclose their non-UK income and assets, including additional tax liabilities together with penalties and interest. This could include income arising from a source outside the UK, assets situated or held outside the UK or activities carried on wholly or mainly outside the UK. The challenge can surmount to a daunting prospect for wealthy individuals with global, inter-connected and complex tax affairs. The declaration will affect not only past, but also future tax liabilities.

As part of the disclosure, made via the online Digital Disclosure Service, the taxpayer also needs to self-assess his or her behaviour, ranging from “careless” to “deliberate and concealed”. This self-assessment is an integral part of disclosure that determines the penalties applied and whether further action is warranted. Understanding the spirit of the Requirement to Correct (RTC) legislation is therefore crucial, for mis-reporting could compound the already very penile penalty rate, equivalent to 200% of the tax liability which should have been disclosed to HMRC under the RTC but was not. Rather frightfully, HMRC reserves complete discretion to conduct a criminal investigation in relation to the disclosure, whether it appears to be complete or incomplete.

The inevitable question arises: how much does HMRC now know, or rather, not know.

Tax investigations can be stressful if you are going it alone and most often merit professional advice. Our team of advisors in North West London is here to help.

Contact Mouktaris & Co Chartered Accountants to ensure that you report correctly and avoid the potential repercussions, of getting it wrong.

The taxation of Cryptocurrency profits is not so virtual

Cryptocurrency investors navigating 100% price swings and exchanges with generous down-time have, this tax season, encountered another hurdle: the tax authorities. Whilst the question “should I report my bitcoin profits?” was clarified by the Inland Revenue some four years ago, the more sobering questions of “how to report bitcoin profits?” and “how much will I be taxed?” have made it to the front of the line.

Whilst bitcoin continues to stir controversy for its inherent value, how bitcoin is accounted for is a far less epistemological thought- rooted in the International Financial Reporting Standards which, unsurprisingly, have not budged.

Currency (why don’t you come on over)

Cryptocurrency is not issued or backed by any government (at least for now), and so cannot be classified as “cash”. Nor does cryptocurrency confer to the holder a contractual right to receive cash or another financial asset (excuse the formulaic definition of “financial instrument”). Of course bitcoin has no physical form, so it cannot be accounted for as “property, plant and equipment”. This narrows down its classification to either of two forms, depending on the circumstances of the investor.

Inventory

Inventories are held for sale in the ordinary course of business. If you are a private investor who actively trades in bitcoin, for example, but not restricted to, “mining” coins, HMRC will view your ownership of bitcoin to be “for sale in the ordinary course of your business”. Consequently your profits will be deemed to be “income” which, as you know, is taxed at 20%, 40% and 45% instead of 10% or 20% as with Capital Gains Tax (CGT). HMRC and the courts will apply any of nine “badges” in deciding whether an activity constitutes a trade so professional advice should be sought on the optimal setup for a trader, as well as the tax and reporting implications.

Intangible assets (IAS 38)

Cryptocurrencies also meet the definition of an intangible asset: one which can be sold, exchanged or transferred individually and which has no physical form. This treatment of bitcoin as an intangible is pioneering for three reasons:

- This intangible asset is traded with a profit motive. Remember, intangible assets, say patents or brand names, have traditionally been assets held for use in the production process.

- Because of its essence in having no physical form, bitcoin carries low detection risk, compounding the profit motive above.

- Scale, and the sheer volume of investors who have crowded into this trade, compounding one and two above.

Taxation of bitcoin as an intangible attracts CGT at the less penile rates of 10% and 20%, depending on your tax bracket. In this case, investors would do well to seek professional advice on the correct measurement basis of gains and, for example, working out the tax when you have held different parts of your bitcoin portfolio for different periods of time.

How will they know (if I really own it)?

One theme from this tax season has been the reportability of cryptocurrency-related profits (though surprisingly, not so much losses!?). Note the following: UK-based trading platforms must provide data to HMRC on their customers. This may seem a moot point for now because the vast majority of cryptocurrency trading in the UK takes place on overseas exchanges, which may explain the low incidence of tax investigations. In this era of cross-border information sharing however, cross-border information sharing of cryptocurrency activity, and traders, may not be far away. In the US, Coinbase, the country’s most popular exchange, has already handed over identity information of 14,000 of its most frequent traders to the Inland Revenue Service. It would be fair to assume that HMRC too will tackle this traceability issue heads-on: tax payers who do not properly report their gains of virtual currency transactions may find themselves with penalties and interest.

Investment in cryptocurrencies merits investment in professional advice, whether you have made profits, or losses.

Contact Mouktaris & Co to ensure that you report correctly, structure optimally and avoid the pitfalls, and potential repercussions, of getting it wrong.

Stay compliant, and keep hydrated.

- ‹ Previous

- 1

- 2

- 3

- 4

- Next ›