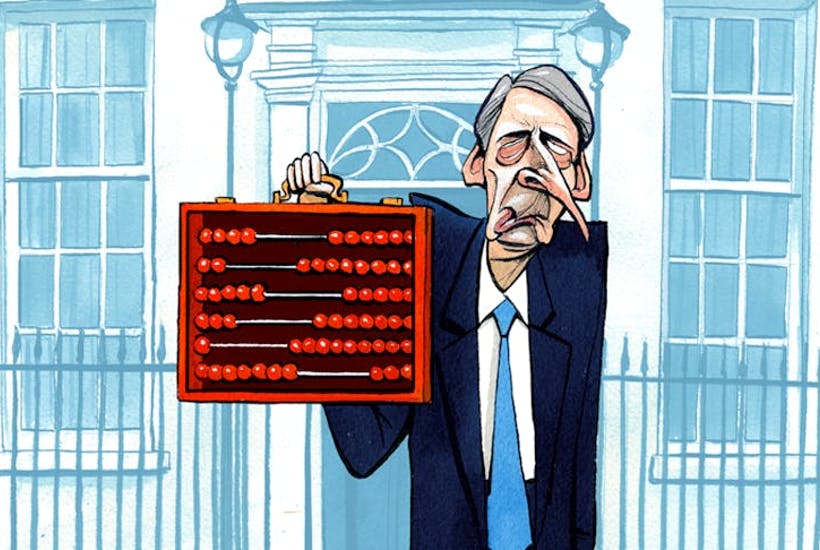

Autumn Budget 2017

Chancellor Philip Hammond presented the 2017 Autumn Budget against a backdrop of ongoing economic uncertainty. In no uncertain terms, this was a glum budget. The Office for Budget Responsibility revised down its outlook for productivity growth, business investment and GDP growth across the forecast period, though the chancellor challenged the nation to “prove them wrong”.

Off we go.

The Chancellor announced the immediate abolition of stamp duty land tax for first-time buyers on homes worth under £300,000, and a rise in the tax-free Personal Allowance to £11,850 from April 2018.

Also unveiled in the Autumn Budget was a change to business rates revaluations: these will now take place every three years, as opposed to every five years, beginning after the next revaluation, currently due in 2022. The Chancellor also addressed the issue of the so-called ‘staircase tax’.

Our Budget Report summarises the key announcements arising from the Chancellor’s speech. Additionally, throughout the Report you will find useful tips and ideas for tax and financial planning, as well as an informative 2018/19 Tax Calendar.

Don’t forget, we can help to ensure that your accounts are accurate and fully compliant, as well as suggest strategies to minimise your tax liability and maximise your profitability.

If you would like more detailed, one-to-one advice on any of the issues raised in the Chancellor’s Budget speech, including on the ensuing tax implications, please feel free to call on 020 8952 7717 to see how we can help.